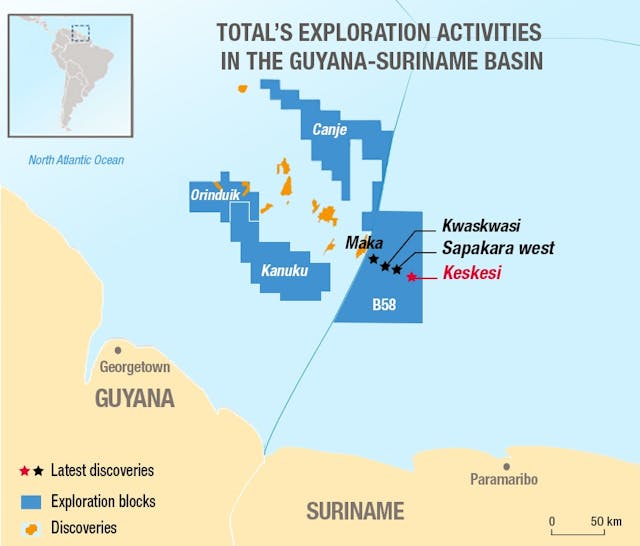

Suriname’s emergence as a significant player in the global oil market is not just a local or regional story, it has the potential to reshape energy geopolitics. With a population of under one million and a GDP of less than $6 billion, Suriname is a small nation on the cusp of a big transformation. Its offshore oil discoveries, concentrated in Block 58 and surrounding areas, are estimated to contain billions of barrels of recoverable crude.

Global energy giants such as TotalEnergies, APA Corporation, and Petronas are placing strategic bets on the region, with exploration and development activities accelerating. This renewed interest is based not only on the promise of oil but on the rare combination of geological potential, political stability, and regional momentum.

As global demand shifts and the energy transition looms, companies are carefully choosing where to invest. Suriname offers a “low-hanging fruit” scenario – relatively underexplored but promising basins, a government eager to collaborate, and neighboring models like Guyana that prove success is possible – even rapid.

What Makes Suriname’s Oil Different?

Unlike heavy, sour crudes found in parts of the Middle East and Venezuela, Suriname’s offshore reserves tend to be light and sweet crude, highly desirable in global markets due to its lower refining cost and smaller environmental footprint.

This plays into the broader narrative of “greener hydrocarbons” – oil that is cheaper and cleaner to extract and refine, which has a better chance of fitting into the evolving global energy mix that still relies on fossil fuels but demands lower emissions.

Additionally, companies in Suriname are looking to leapfrog older technologies. They are integrating AI-based reservoir modelling, remote subsea systems, and predictive maintenance technologies to minimize operational costs and environmental risks. This early adoption could help Suriname set a new standard for frontier oil regions.

A Region Poised for Collective Dominance

South America’s repositioning as an oil powerhouse rests on more than just Suriname. Together with Guyana, Brazil, and potentially Argentina, the continent is forming an energy triangle with the following strategic pillars –

Guyana, A Warning and a Blueprint

Guyana’s meteoric rise has not gone unnoticed. Since the first major find in 2015, the country has seen exponential growth in oil output. ExxonMobil, along with Hess and CNOOC, now lead a booming sector that could generate over $7 billion in oil revenues annually by 2027.

However, Guyana has also faced criticism for slow revenue distribution, environmental concerns, and overdependence on foreign firms. These are critical lessons for Suriname to heed as it drafts contracts and regulatory frameworks.

Brazil, The Veteran Innovator

Brazil remains the regional giant. Its pre-salt offshore fields, discovered in the 2000s, have put it in the top 10 oil producers globally. Petrobras, the state-controlled energy major, is undergoing a modernization drive, including carbon capture, cleaner refining processes, and digital oilfield platforms.

Yet Brazil, too, faces uncertainty. The dual pressure of global decarbonization goals and political instability (with fluctuating policies between administrations) make its oil narrative more complex.

Argentina, The Shale Underdog

While less prominent, Argentina’s Vaca Muerta shale formation is among the world’s largest. If infrastructure and political hurdles can be overcome, it could serve as a continental counterbalance to offshore giants like Brazil and Guyana.

In 2023 and 2024, the country achieved record shale oil and gas outputs. With plans underway to reach 1 million barrels per day by 2030, Argentina is charting a path to energy self-sufficiency, and potentially to becoming a net exporter.

Economic Hurdles Remain

However, the journey is far from smooth. Chronic economic instability, persistent inflation, and a volatile currency have long deterred foreign investment. Moreover, poor infrastructure, especially bottlenecks in pipeline and export terminals, could hinder Argentina’s full energy potential. Nevertheless, global energy players like Chevron, Shell, and YPF remain invested, believing in the long-term value of the country’s resources.

Suriname, The New Frontier of Deepwater Oil

Since 2020, offshore exploration led by TotalEnergies and APA Corporation has revealed that Suriname’s deepwater blocks could hold more than 6 billion barrels of oil, an extraordinary find for a country of just over 600,000 people. These discoveries have made Suriname the most talked-about new entrant in South America’s oil scene.

Unlike early producers who had to learn from a steep learning curve, Suriname is benefiting from hindsight. Its regulators and operators are taking a measured, technology-forward approach –

-Automated drilling rigs in ultra-deep waters

-3D seismic mapping and AI-based data analysis

-Digital twins to simulate extraction and optimize flow rates

This calculated pace is allowing Suriname to avoid the boom-and-bust mistakes seen in oil-rich countries like Venezuela.

Challenges and Potential

Still, Suriname’s success hinges on more than geology.

The country faces – a lack of domestic infrastructure, including pipelines and refineries, a need to diversify the economy to avoid oil over-dependence, governance and financial transparency issues, which can become Achilles’ heels if not addressed early

But if managed wisely, Suriname could catalyze a new era for the Guiana Basin, joining Guyana to redefine the Caribbean coast as a vital hydrocarbon hub.

Is the Global Energy Transition at Risk?

The rise of new oil powers in South America arrives amid a global push for decarbonization. Countries like Suriname are entering the oil race just as others are trying to phase out fossil fuels.

Hence, for nations like Suriname, the oil boom presents both an opportunity and a risk –

–Should they invest heavily in oil infrastructure?

–Or use oil revenue as a bridge to build renewable capacity?

Technologies like carbon capture and storage (CCS) and green hydrogen production could help mitigate emissions, but they require massive capital and international collaboration. Without such measures, new oil producers could find themselves out of sync with global climate goals, risking sanctions, falling demand, and reputational costs.

But Is Fossil Fuel Demand Really Declining?

Despite global climate ambitions, the war in Ukraine has revealed a sobering truth – the world still depends heavily on oil and gas.

The conflict has – disrupted energy markets, especially in Europe. Triggered record-high energy prices. Forced even green-leaning nations to reinvest in LNG and coal and illustrated geopolitical vulnerabilities in energy security

This has created a renewed urgency for diversification of supply, and that’s where emerging producers like Suriname come in. The world may be transitioning, but it is doing so unevenly and under the shadow of geopolitics.

What Are the Risks and Obstacles?

For every oil success story, South America has a cautionary tale.

Venezuela’s Decline – The country with the world’s largest proven reserves now produces less than 700,000 barrels per day, down from over 3 million in the early 2000s.

The reasons, sanctions, corruption and mismanagement, and a complete collapse of state-run PDVSA.

Colombia and Ecuador – Colombia faces declining reserves, social unrest, and environmental pushback. Ecuador, with fiscal constraints, is struggling to modernize its energy sector despite recent interest in offshore blocks.

Hence, if Suriname can thread this needle, it may avoid the fates of other oil-rich but misgoverned nations, and usher in a new era of strategic energy leadership in the Western Hemisphere.

What Could Suriname’s Rise Mean for OPEC?

The quiet emergence of Suriname and its neighbor Guyana, as oil producers is no longer a footnote in the global energy story. Instead, it signals a potential shake-up for the world’s most influential oil cartel – OPEC.

For decades, OPEC has steered the global oil market, adjusting production levels to maintain prices and geopolitical leverage. But as Suriname prepares to enter full-scale production, and with Guyana already ramping up exports, a subtle rebalancing of power may be underway. These non-OPEC nations, flush with newfound reserves, aren’t tethered to OPEC’s quotas or political intricacies. They are agile, investor-friendly, and committed to growth, making them attractive suppliers to a world still heavily dependent on oil.

The more countries like Suriname enter the field, the harder it becomes for OPEC to control supply. The cartel may find itself recalibrating production strategies or even extending membership offers to new players to preserve its influence. Angola’s recent exit from OPEC already raised eyebrows, exposing cracks in unity and hinting at growing restlessness among members.

Still, the influx of oil from non-OPEC countries may bring benefits for global consumers. More competition generally means lower prices, improved supply security, and a less monopolistic energy market, offering some relief to developing nations struggling with high energy costs.

But for OPEC, the rise of Suriname signals a deeper issue, it’s not just about barrels anymore – it’s about relevance.

The Last Bit, Will Suriname’s Oil Boom Truly Reach Its People?

Beyond the international buzz and investor excitement, Suriname’s oil era must ultimately serve one core purpose – uplifting its citizens.

That’s the challenge President Chan Santokhi is attempting to meet head-on. His “royalty for all” initiative is a rare move in the oil world, a commitment to ensuring that every citizen directly benefits from the country’s newfound wealth. By placing $750 into individual savings accounts, earning 7% annual interest, the plan aims to democratize the dividends of petroleum.

Suriname’s projected windfall – estimated at up to $10 billion over the next two decades – is significant for a nation of less than a million people. But raw numbers only matter if translated into tangible progress – better schools, modern hospitals, job creation, and clean water systems.

To avoid the infamous “resource curse,” Suriname has also established a sovereign wealth fund modeled after Norway’s success. It’s a sign the country is thinking long-term, about resilience, not just revenue.

Still, risks remain. Environmental damage from spills, unequal wealth distribution, and governance challenges could quickly derail progress. Suriname’s journey will be closely watched, not just as a case study for oil economics, but as a test of whether a small nation can truly harness energy wealth to power inclusive, sustainable development.

If it succeeds, Suriname could become more than an oil producer, it could become a model.